Latin America felt little pain from President Donald Trump’s sharp H-1B visa fee hike. Yet if the U.S. move speeds up outsourcing, the region could turn out to be its biggest winner.

“It could be a golden opportunity,” declared El Economista, Mexico’s financial daily.

Mexico’s advantage goes far beyond geography. It shares a border with the U.S., enjoys the USMCA trade deal, and — crucially — has access to another visa channel: the TN visa, a cheaper and faster alternative to the H-1B.

Unlike the H-1B, the TN visa remains untouched by the new fee increase. It offers a more economical and expeditious route for skilled professionals to work in the U.S., the paper noted. Granted under the trade pact, the TN visa lasts up to three years and can be renewed indefinitely, as long as the holder maintains non-immigrant intent.

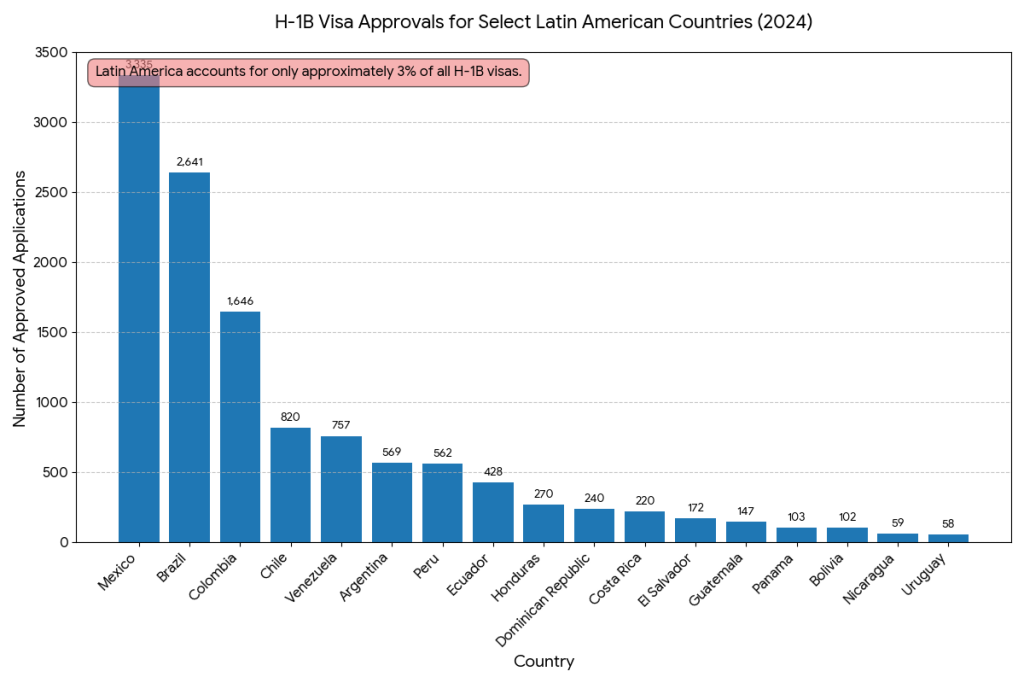

Still, Latin America’s share of U.S. visa approvals is tiny — just 3% of all H-1B approvals in fiscal 2024. Mexicans received 3,335 visas, Brazilians 2,641, and Colombians 1,646, according to data from U.S. Citizenship and Immigration Services (USCIS).

Rather than lobbying Washington to reverse Trump’s decision, U.S. firms appear to be quietly nearshoring — building new operations just south of the border.

Just days after Trump’s announcement, American cloud giant Salesforce set aside $1 billion to expand in Mexico — building a new delivery center and creating a regional talent hub for its global operations.

“The $100K H-1B fee won’t stop companies from hiring global talent — it’ll just change where that talent sits,” said Fraser Patterson, CEO at Skillit, a New York City-based staffing firm.

“Nearshoring to places like Mexico, Colombia, and Brazil solves that.”

The Mindset is Changing

Does Salesforce’s billion-dollar bet signals a shift? Chris Ross, Vice President of Emapta, an offshore staffing firm that builds and manages global teams for tech clients, confirmed that many U.S. firms he works with are clearly embracing a borderless mindset.

Emapta serves as a local employer, handling all HR-related functions while clients retain full ownership of operations. This method of talent sourcing — known as Employer of Record (EOR) — is likely to become even more attractive in the absence of H-1B visas.

Yet the shift won’t be risk-free, warns Ryan L. Eddings, Partner at Hanson Bridgett LLP.

“Those firms may face greater pressure to comply with cross-border regulations and data privacy laws (like Brazil’s LGPD or Colombia’s Habeas Data),” he cautioned.

“They may also see increased U.S. legal exposure via joint-employer or supply-chain liability claims.”

Still, Eddings believes that if companies can successfully steer through the legal maze, the payoff could be massive for nearshore firms.

Remote Working for the U.S.

“Even without the visa changes, forward-looking U.S. companies should already be shifting to globally distributed models,” Ross added.

Data supports his point. The size of several Latin American tech firms managing remote workers for U.S. clients has surged since 2021.

BairesDev, the Argentine software outsourcer, is a prime example. It employs more than 4,000 professionals across the region — from small towns to major cities — serving about 500 U.S. clients, according to the Financial Times.

The sky-high visa fee, says Javier Palomarez, Founder & CEO of the United States Hispanic Business Council (USHBC), is pushing many U.S. firms to expand their talent base beyond national borders.

“The small and mid-sized tech companies we talk to are estimating a 50–75% savings in the hiring process if they offshore instead of apply for new visas,” he said.

These investments, Palomarez added, will take time and planning — most firms are still in the early stages.

“For smaller companies priced out of H-1Bs where passing hiring isn’t an option, the key is going to be rethinking your hiring model rather than retreat,” Patterson added.

Add comment